By John Vibes | Creative Commons | TheMindUnleashed.com

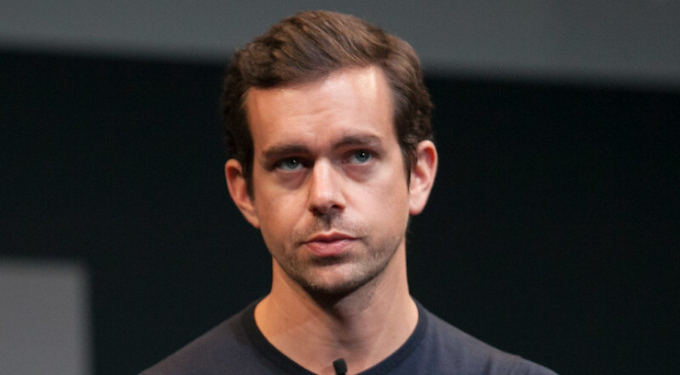

(TMU) — Twitter co-founder and CEO Jack Dorsey announced that he will be pledging $1 billion to help fund coronavirus economic relief efforts. This donation is not only large in scale but is also a relatively large portion of Dorsey’s overall wealth—roughly 28% of his total 3.9 billion net worth.

The money will come from his personal stake in Square Inc., the payment processing company that he also co-founded.

Dorsey tweeted a link to a document where information about the donations will be posted, including the amount of the donation and the recipient.

I’m moving $1B of my Square equity (~28% of my wealth) to #startsmall LLC to fund global COVID-19 relief. After we disarm this pandemic, the focus will shift to girl’s health and education, and UBI. It will operate transparently, all flows tracked here: https://t.co/hVkUczDQmz

— jack (@jack) April 7, 2020

“The impact this money will have should benefit both companies over the long-term because it’s helping the people we want to serve,” Dorsey said in a follow-up tweet.

Other billionaires have offered donations to different causes related to the pandemic, but this is by far the largest.

Jeff Bezos, Amazon founder and richest person in the world, offered a donation of $100 million to Feeding America, which also happened to be the first charity to receive a donation from Dorsey. Michael and Susan Dell also pledged to donate $100 million to relief efforts.

Dorsey has been known to make radically generous moves that are almost unheard of for people in his position. In 2015, Twitter was forced to lay off about 8 percent of its employees. Dorsey donated $200 million in Twitter stock back to the employee grant pool as a consolation. At the time this was about a third of the stake that he had in Twitter.

At the time he tweeted, “I’d rather have a smaller part of something big than a bigger part of something small. I’m confident we can make Twitter big!”

Last week, a record 6.6 million people filed for unemployment benefits in the United States. Economists expect many more applications to be filed in the coming weeks and months.

![Everything You Ever Wanted to Know About 9/11 Conspiracy Theory in Under 5 Minutes [VIDEO] | by James Corbett](https://consciouslifenews.com/wp-content/uploads/2018/09/911-a-conspiracy-theory-120x86.jpg)