The intent of any business is to serve customers by providing relevant services or selling products. A large enterprise will have separate teams for product development, sales, marketing, finance, etc. but a small business may not be in a position to have so many decisions.

A small business has to hustle and wear multiple hats so that the business progresses in the right direction. Though it is good to hustle, business owners need to find ways to optimize their business processes. Every business owner aims to generate profit from the business hence, the owner or the accounts team needs to keep a close watch on the finances i.e. earnings, income, profit, etc.

This is where a statement of financial position comes handy as it is a statement about the firm’s assets, liabilities, and net worth. The statement of financial position is called the Balance Sheet. The balance sheet provides an in-depth view of how the business is performing at any point in time. The balance sheet can be prepared at the end of a financial year or the end of every month or the end of every quarter.

Balance Sheet gives detailed insights about the performance of the business and balance sheets from previous years can be compared to gauge how the business has progressed. It is termed as balance sheet as the net assets (i.e. assets minus liabilities) should equate to the owner’s equity.

Balance sheet preparation is essential as it is vital for seeking outside investment in a firm, submitting taxes, or applying for loans. The major components that constitute a balance sheet are assets, liabilities, and net worth (owner’s equity). Let’s look at each component in greater detail:

Assets – Assets are the valuables that are owned by the company that helps them generate income. Assets can be categorized into tangible and intangible assets. For a research organization, trademarks and patents are the key assets as they have future economic value. These are termed as non-tangible or intangible assets.

Tangible assets can be again categorized into three categories – current assets, long-term assets, and other assets. As the name suggests, the current asset is something that generates revenue (or cash) for the company or can be converted into cash within one year. Common examples of current assets are cash, accounts receivable, etc.

On the other hand, long-term assets will be instrumental in generating revenue over a longer period. They are also referred to as fixed assets. All the long-term assets (except land) have to be shown on the balance sheet at the original cost minus the depreciation.

Liabilities – Liabilities are the debts that are owed by the business. A common example is a company securing a long-term loan for expansion of the business. Liabilities can be classified into two broad categories – current liabilities and long-term liabilities.

Current liabilities are accounts payable, taxes payable, debt that is due within a year, etc. On the other hand, long-term liabilities refer to the dues owed by the business for more than a year from the preparation of the balance sheet.

Net Worth – Net worth is also termed as Equity for a sole- proprietorship business. Equity, also called book value of the company is the assets owned by the owner (or promoter) of the business. In simple terms, the owner can sell all the assets to nullify (or repay) the debts. The remaining portion is the owner’s equity.

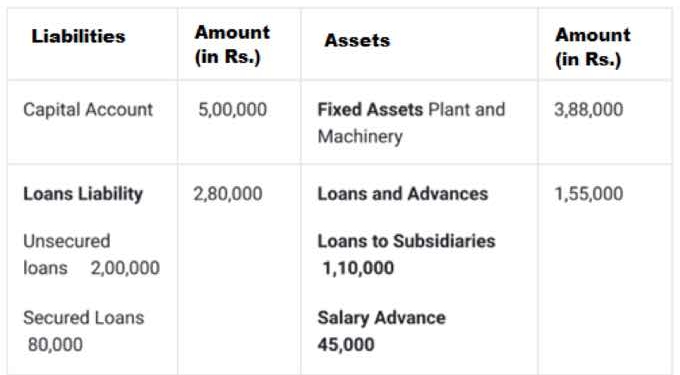

Shown below is a sample balance sheet:

To summarize, irrespective of the scale or size of the business, it is important to maintain a balance sheet as it is a snapshot of your business. The balance sheet also helps in planning further business activities as it provides the key pointers required for decision making.