By Dr. Joseph Mercola | mercola.com

STORY AT-A-GLANCE

- In the first quarter of 2021, 15% of U.S. homes sold were purchased by corporate investors — not families looking to achieve their American dream

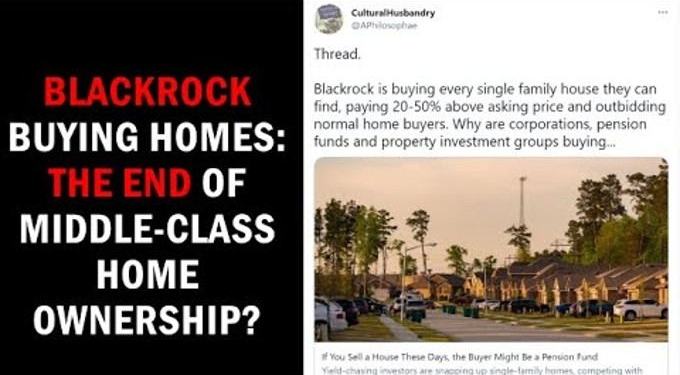

- The average American has virtually no chance of winning a home over an investment firm, which may pay 20% to 50% over the asking price, in cash, sometimes scooping up entire neighborhoods at once

- BlackRock, one of the largest asset management firms, is among the firms buying up U.S. houses; they also control the media and Big Pharma

- If the average American is pushed out of the housing market, and most of the available housing is owned by investment groups and corporations, you become beholden to them as your landlord

- This fulfills part of the Great Reset’s “new normal” dictum — the part where you will own nothing and be happy; this isn’t a conspiracy theory — it’s part of WEF’s 2030 agenda

Homeownership has long been considered an important tool for building financial security and wealth, but it’s becoming more difficult for Americans to achieve. Younger generations are less likely to own a home than those from older generations, with millennials’ homeownership rate 8% lower than that of generation X and baby boomers at the same age.1

If the rate had remained steady, about 3.4 million more people would own homes in the U.S. today but, instead, younger adults are increasingly choosing to either rent or live with their parents. There are a number of reasons why homeownership has become less attainable than it was decades ago, from rising debt in younger generations to increased cost of living.

A report by the Urban Institute found half those aged 18 to 34 were spending upward of 30% of their income on rent, making them “rent-burdened.”2 Meanwhile, median housing prices increased 28% in the last two years,3 pricing some out of the market. However, the shift is not all happenstance.

In the first quarter of 2021, 15% of U.S. homes sold were purchased by corporate investors4 — not families looking to achieve their American dream. While they’re competing with middle-class Americans for the homes, the average American has virtually no chance of winning a home over an investment firm, which may pay 20% to 50% over the asking price,5 in cash, sometimes scooping up entire neighborhoods at once so they can turn them into rentals.6

BlackRock Is Buying Up US Houses

BlackRock is one of a number of companies mentioned by The Wall Street Journal in a recent exposé. “Yield-chasing investors are snapping up single-family homes, competing with ordinary Americans and driving up prices,” they warned.7 The question is, why would institutional investors and BlackRock, which manages assets worth $5.7 trillion,8 be interested in overpaying for modest, single-family homes?

To understand the answer, you must look at BlackRock’s partners, which include the World Economic Forum (WEF),9, and their extreme political and financial clout. In a Twitter thread posted by user Culturalhusbandry, it’s noted:10

“Black Rock, Vanguard, and State Street control 20 trillion dollars worth of assets. Blackrock alone has a 10 billion a year surplus. That means with 5-20% down they can get mortgages on 130-170k homes every year. Or they can outright buy 30k homes per year. Just Blackrock.

… Now imagine every major institute doing this, because they are. It can be such a fast sweeping action that 30yrs may be overshooting it. They may accomplish feudalism in 15 years.”

If the average American is pushed out of the housing market, and most of the available housing is owned by investment groups and corporations, you become beholden to them as your landlord. This fulfills part of the Great Reset’s “new normal” dictum — the part where you will own nothing and be happy. This isn’t a conspiracy theory; it’s part of WEF’s 2030 agenda.11

The unstated implication is that the world’s resources will be owned and controlled by the technocratic elite, and you’ll have to pay for the temporary use of absolutely everything. Nothing will actually belong to you, including your home. All items and resources are to be used by the collective, while actual ownership is restricted to an upper stratum of social class. The wealth transfer has already begun.

BlackRock’s Unrivaled Control

The New York Times and a majority of other legacy media are largely owned by BlackRock and the Vanguard Group, the two largest asset management firms in the world, which also control Big Pharma. And it doesn’t end there.

BlackRock and Vanguard are at the top of a pyramid that controls basically everything, but you don’t hear about their terrifying monopoly because they also own the media. You can watch all the details about BlackRock’s monopoly in this video, but Humans Are Free summed it up this way:12

“The power of these two companies is beyond your imagination. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. This gives them a complete monopoly. A Bloomberg report states that both these companies in the year 2028, together will have investments in the amount of 20 trillion dollars. That means that they will own almost everything.

Bloomberg calls BlackRock ‘The fourth branch of government,’ because it’s the only private agency that closely works with the central banks. BlackRock lends money to the central bank but it’s also the advisor. It also develops the software the central bank uses.

… BlackRock, itself is also owned by shareholders … The biggest shareholder is Vanguard … The elite who own Vanguard apparently do not like being in the spotlight but of course they cannot hide from who is willing to dig. Reports from Oxfam and Bloomberg say that 1% of the world, together owns more money than the other 99%.

Even worse, Oxfam says that 82% of all earned money in 2017 went to this 1%. In other words, these two investment companies, Vanguard and BlackRock hold a monopoly in all industries in the world and they, in turn are owned by the richest families in the world, some of whom are royalty and who have been very rich since before the Industrial Revolution.”

BlackRock May Control the World’s Economic Future

To put this into perspective, BlackRock, an investment firm, has more power than most governments on Earth, and it also controls the Federal Reserve, Wall Street mega-banks like Goldman Sachs, and the WEF’s Great Reset, according to F. William Engdahl, a strategic risk consultant and lecturer who holds a degree in politics from Princeton University.13

Engdahl believes that left unchecked, BlackRock will soon control the economic future of the world, and states, “BlackRock is the epitome of what Mussolini called Corporatism, where an unelected corporate elite dictates top-down to the population.”14 For instance, three influential economic appointees of the current administration come from BlackRock.

“There is a definite pattern and suggests that the role of BlackRock in Washington is far larger than we are being told,” Engdahl says.15 The Campaign for Accountability also released a report in 2019 detailing how BlackRock “implemented a strategy of lobbying, campaign contributions, and revolving door hires to fight off government regulation and establish itself as one of the most powerful financial companies in the world.”16,17

BlackRock founder and CEO Larry Fink also has close ties to WEF’s head Klaus Schwab and joined WEF’s board in 2019. According to Engdahl:

“Fink … now stands positioned to use the huge weight of BlackRock to create what is potentially, if it doesn’t collapse before, the world’s largest Ponzi scam, ESG [Environment, Social values and Governance] corporate investing. Fink with $9 trillion to leverage is pushing the greatest shift of capital in history into a scam known as ESG Investing.

The UN ‘sustainable economy’ agenda is being realized quietly by the very same global banks which have created the financial crises in 2008. This time they are preparing the Klaus Schwab WEF Great Reset by steering hundreds of billions and soon trillions in investment to their hand-picked ‘woke’ companies, and away from the ‘not woke’ such as oil and gas companies or coal.

… Oil companies like ExxonMobil or coal companies no matter how clear are doomed as Fink and friends now promote their financial Great Reset or Green New Deal … And we can expect that the New York Times will cheer BlackRock on as it destroys the world financial structures.”

Blackstone Is the Largest Landlord in the US

Another giant private equity firm, Blackstone, is also deeply entrenched in U.S. real estate. Blackstone is the largest landlord in the U.S. as well as the largest real estate company worldwide, with a portfolio worth $325 billion.18 In June 2021, Blackstone agreed to buy Home Partners of America, a company that rents single-family houses, and its 17,000 houses, for $6 billion.

Blackstone and BlackRock sound-alike for a reason. Blackstone’s co-founder, billionaire Steve Schwarzman, said during an interview on Squawk Box that he and Fink “started in business together. We put up the initial capital.” BlackRock used to be called Blackstone Financial, but Fink went off on his own. Schwarzman said, “Larry and I were sitting down and he said, ‘What do you think sort of about having a family name with ‘black’ in it,'”19 and BlackRock was born.

Blackstone became notorious for swooping in after the housing bubble burst and buying tens of thousands of homes at deeply discounted prices. They then turned them into single-family rentals, taking advantage of the recession. In 2017, Bloomberg reported:20

“Blackstone built its rental-home business with an advantage few if any other buyers could match: billions of dollars in credit from large banks. Its Invitation Homes subsidiary quickly became the largest single-family home landlord in the U.S., with 50,000 properties. Altogether, hedge funds, private-equity firms and real estate investment trusts have raised about $20 billion to purchase as many as 200,000 homes to rent.”

Now, with many struggling due to yearlong business shutdowns and lockdowns, and home prices rising, many Americans are having difficulty finding affordable single-family homes to buy.21

BlackRock Owns Your House, Gates Owns Your Farmland

Both BlackRock CEO Fink and Bill Gates are pushing for “net-zero” carbon emissions.22 But as BlackRock is busy buying up houses, Gates is hard at work amassing farmland and is now the largest owner of farmland in the U.S.23

By 2030, Gates is pushing for drastic, fundamental changes, including widespread consumption of fake meat, adoption of next-generation nuclear energy, and growth of a fungus as a new type of nutritional protein.24 The deadline Gates has given to reach net-zero emissions is 2050,25 likely because he wants to realize his global vision during his lifetime.

But according to Vandana Shiva, in order to force the world to accept this new food and agricultural system, new conditionalities are being created through net-zero “nature-based” solutions. Navdanya’s report, “Earth Democracy: Connecting Rights of Mother Earth to Human Rights and Well-Being of All,” explains:26

“If ‘feeding the world’ through chemicals and dwarf varieties bred for chemicals was the false narrative created to impose the Green Revolution, the new false narrative is ‘sustainability’ and ‘saving the planet.’ In the new ‘net zero’ world, farmers will not be respected and rewarded as custodians of the land and caregivers, as Annadatas, the providers of our food and health.

… ‘Net Zero’ is a new strategy to get rid of small farmers in first through ‘digital farming’ and ‘farming without farmers’ and then through the burden of fake carbon accounting.

Carbon offsets and the new accounting trick of ‘net zero’ does not mean zero emissions. It means the rich polluters will continue to pollute and also grab the land and resources of those who have not polluted — indigenous people and small farmers — for carbon offsets.”

A New Wave of Colonization

Ultimately, we’re heading for a new wave of colonization in the name of sustainability and net-zero carbon emissions. The solutions are complex. Some have suggested that one solution is to make building homes less expensive so that new construction homes become less expensive. This, in turn, would drive down the cost of existing homes.27

The video at the top of this article goes into detail about another solution: ending the Federal Reserve to stop the central planning of our money supply and interest rates, which are artificially suppressed in a way that is most taken advantage of by the top 1%, contributing to growing wealth inequality.28

This engineered pandemic has catalyzed the transfer of wealth to the rich and, while the major players pushing for the Great Reset are still emerging, BlackRock and Blackstone are names to keep your eye on.