By Daniel Bortz | Consumer Reports

When was the last time you took a close look at your expenses? If it’s been a while, the new year is a good time to figure out whether you’re wasting money on things you don't really need—or may be overlooking.

This isn’t about giving up restaurants or skipping vacations. Instead, it’s about plugging those “money leaks”—small, often hidden costs that slowly drain your checking account without you even noticing. Over months and years, these small leaks can add up to hundreds, if not thousands of dollars.

Here are six common money leaks you should look out for—with tips on how to patch them up:

1. Paying too much for car insurance.

Once your car is 10 years old, the cost of collision coverage can be more than the vehicle is worth, says Margarita Dilone, an independent insurance agent with Crystal Insurance in Washington, D.C.

So check your car insurance policy to see whether your premiums and deductible for collision coverage equal or exceed the value of your vehicle, Dilone says. If your car truly is a clunker, it might be time to skip that coverage, which can cut your insurance bill as much as 75 percent, she adds.

2. Not bundling all of your insurance.

If you buy insurance policies for your car and your home separately, you could be paying more than necessary. But if you bundle, you'll probably save money.

According to Angela Testa, a State Farm representative, for each insurance policy that you buy bundled, discounts generally range from 10 percent to 20 percent, depending on where you live. According to data compiled by insuranceQuotes.com, if you live in Louisiana, for example, you could save an average of 19.68 percent off your total auto insurance and home insurance premiums by bundling. That amounts to an average of $584 per year in premiums paid in that state.

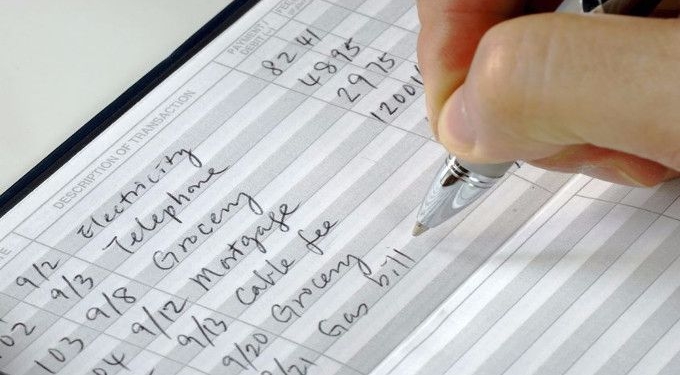

3. Overlooking checking account fees.

Some financial institutions charge service fees typically ranging from $5 to $15 per month for checking accounts. That’s a fee some customers overlook when opening an account.

Many banks will waive these fees, however, if you meet certain requirements, such as setting up a direct deposit account, opening a second account, or completing a certain number of transactions each month.

A Bank of America Core Checking Account, as it is known, levies a $12 monthly fee but will waive it if you make a direct deposit of $250 or more, maintain a minimum daily balance of $1,500 or more, or are a student under the age of 23.

Check with your bank to see whether you’re paying a checking account fee. If you are, find out whether there are ways to have it waived—or whether the bank has a different no-fee checking account that meets your needs and can help you save money.

“If neither pans out, switch to another bank that does,” says Greg McBride, a chief financial analyst at Bankrate.com.

4. Not using a programmable thermostat.

In the U.S., energy costs consume between 5 and 22 percent of the average family’s total after-tax income, according to WalletHub.com. But buying a programmable thermostat ($150 to $250 on average) can cut costs significantly.

Turning the temperature down 7 to 10 degrees for 8 hours each day (such as at night) from its normal setting can help you save money—up to 10 percent, or about $180 per year, according to Energy.gov.